The Rise of Decentralized Autonomous Organizations: A Paradigm Shift in the Cryptocurrency World

Table of Contents

This blog post will provide an in-depth analysis of Decentralized Autonomous Organizations (DAOs) and their profound impact on the cryptocurrency industry. It will discuss how DAOs are revolutionizing traditional organizational structures by eliminating intermediaries and allowing for transparent, decentralized decision-making processes. The post will also explore various successful examples of DAOs and discuss the potential challenges and opportunities associated with this emerging trend.

An overview of the Decentralized Autonomous Organization

A decentralized autonomous organization (DAO) is a type of legal structure in which all members collaborate to accomplish a shared purpose in the absence of a centrally located governing authority. DAOs, which are popular among fans of blockchain technology and cryptocurrencies, are used to make decisions by applying a bottom-up management strategy.

DAOs are seen as the essential element of Web3, cryptocurrency, and blockchain applications. The key point is that DAOs make it simple for users to establish decentralized organizations. The crypto space gains greatly from DAOs. In addition to automating several financial procedures, these structures are primarily utilized for capital fund raising. For instance, at Ethereum, we make sure that stakeholder pay complies with universally accepted guidelines.

The Potential Benefits of Decentralized Autonomous Organizations

Decentralization

The primary advantage of the DAO is its elimination of the requirement for a single point of governance. Despite being controlled by smart contracts, this increases the transparency and accountability of DAOs, allowing all members to see how the group is operated.

Transparency

Every decision and transaction is documented on a blockchain, which is visible to all members of the public. By fostering a transparent environment where each individual can engender confidence and trust among themselves, fraudulent activity may be stopped.

Efficiency

DAOs provide more effective and efficient transaction than any traditional business. where, in a way, efficiency can be guaranteed. Efficiency improvements and cost reductions will result from this.

The difficulties faced by decentralized autonomous organizations

Individual Liability

When members of decentralized autonomous organizations (DAOs) reject passed proposals, there is uncertainty about their personal accountability. Concerns regarding the integration on off-chain assets are raised by the DAOs' ambiguity, which prevents them from expanding outside their on-chain contexts.

Adoption Difficulties

In contrast to conventional stocks, DAOs offer tokens, and token issuers and holders usually wait for governance privileges or financial gains from them. Token holders and DAOs won't have any legal connection, nevertheless. Due to the lack of legal protection, token holders may be at danger. Therefore, it is important to weigh the dangers and difficulties before making a DAO investment.

Legal Concerns

Since it is seen as an inadequate legal structure, formal corporate frameworks that clearly define the various duties of members are lacking. Rather, owners of governance tokens propose measures that the DAO can consider and decide upon. It is a little difficult to trust as the legal structure of DAOs is unclear.

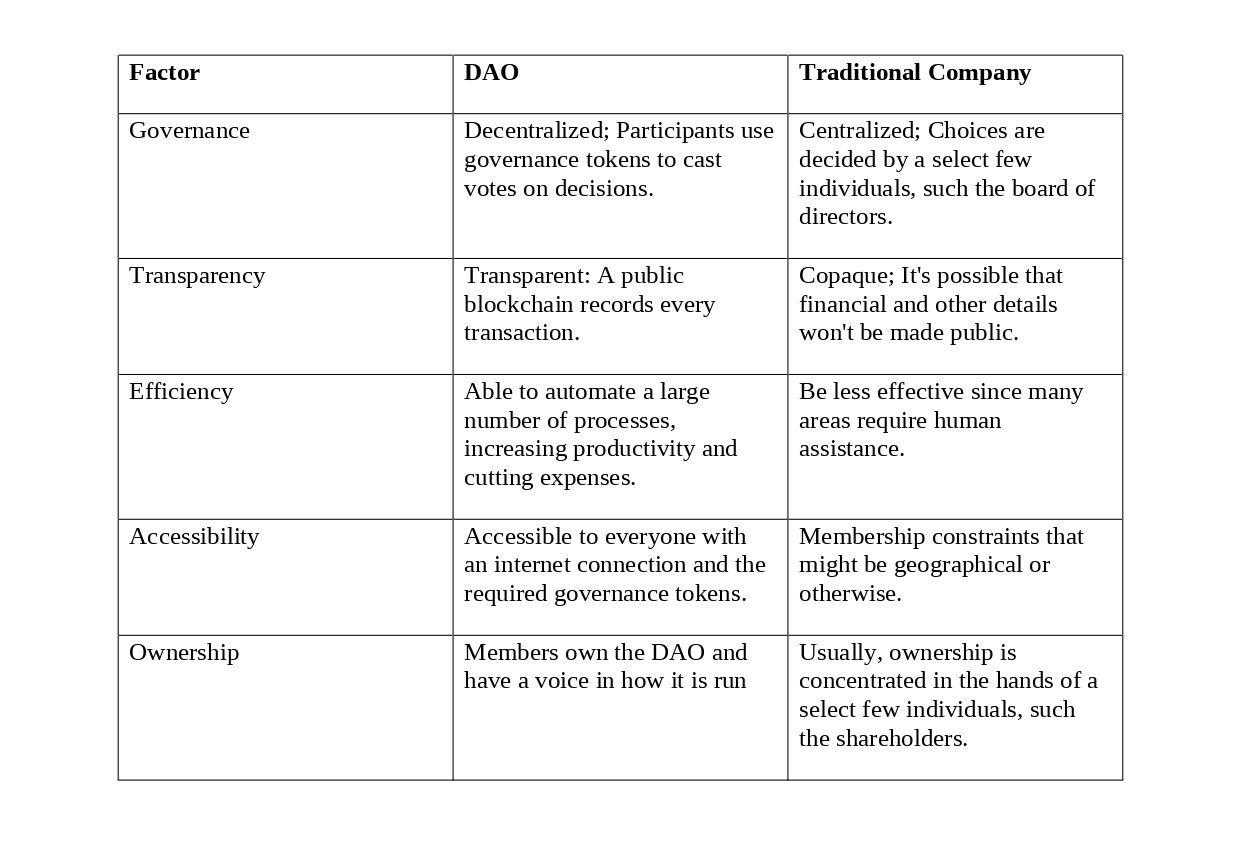

Traditional Organizations vs. Decentralized Autonomous Organizations

Successful examples of DAOs

The DAO

The DAO was one of the first attempts to create a decentralized financial (de-fi) network for venture capital crowdsourcing, therefore it wasn't a very successful project. Sadly, it was breached, leading to the pilfering of ether, the Ethereum currency, valued at $60 million. The money were contentiously returned to their rightful owners by "forking," a procedure that rectified this theft. As a result, Ethereum and Ethereum Classic became two distinct chains on the blockchain.

Decentraland

The stakeholders in this online virtual world, which is run by a DAO, democratically decide on matters of administration and governance. The procedure is open to everybody who holds the platform's token, MANA. Global companies, such as Morgan Stanley, Coca-Cola, and Adidas, are using the platform to reach out to digital-native consumers, and it is rapidly gaining popularity.

Friends With Benefits

A cryptocurrency club where FWB token owners may get together to network and work together on personal projects. Users may connect with other web3 enthusiasts in their community by visiting the dedicated hubs for each city. A user's access to additional engagement and networking options increases with the number of FWB tokens they own.

How DAO's work?

- By using smart contracts, a core group of community members establishes the DAO's regulations. The fundamental basis for the DAO's operation is outlined in these smart contracts. They are made extremely clear, verifiable, and auditable by the public so that any prospective member may see exactly how the protocol is supposed to work at every stage.

- Following the official writing of these regulations onto the blockchain, the DAO must choose how to get financing and distribute governance.

- Token issuance is the usual method used to accomplish this, in which the protocol sells tokens to generate revenue and stock the DAO treasury.

- Token holders receive voting rights in exchange for their money, often in proportion to their holdings. The DAO can be deployed as soon as funding is finalized.

- The agreement obtained through member voting is the only way to modify the code at this point, once it has been deployed into production. That is, the community of token holders has full control over modifying the DAO's rules; no specific authority can do so.

Bottom-Line

So, here we learnt about the impact of Decentralized Autonomous Organizations (DAOs) on the cryptocurrency industry, highlighting their role in eliminating intermediaries and enabling transparent, decentralized decision-making processes. DAOs are essential for Web3, cryptocurrency, and blockchain applications, making it easy for users to establish decentralized organizations. They also automate financial procedures and are used for capital fund raising, such as Ethereum's stakeholder pay compliance with universally accepted guidelines.